After holding above the $107,000 price mark for several days, Bitcoin has finally lost this key range, triggering a bearish movement to the $105,000 threshold as Tuesday drew to a close. A recent report indicates that BTC’s sudden pullback is being met with a significant increase in profit-taking among investors.

As Bitcoin Falters, Network Profit-Taking Surges

Bitcoin’s recent upward momentum has slowed down a little due to waning market sentiment. Meanwhile, the Bitcoin network is seeing a significant resurgence in profit-taking, which appears as the price of BTC starts to sway following a remarkable surge.

The heightened profit-taking from investors was reported by Glassnode, a leading on-chain data analytics firm, after examining the BTC Realized Profit metric. A growing profit-taking coinciding with falling prices implies that BTC investors are looking to lock in gains in order to avoid further losses.

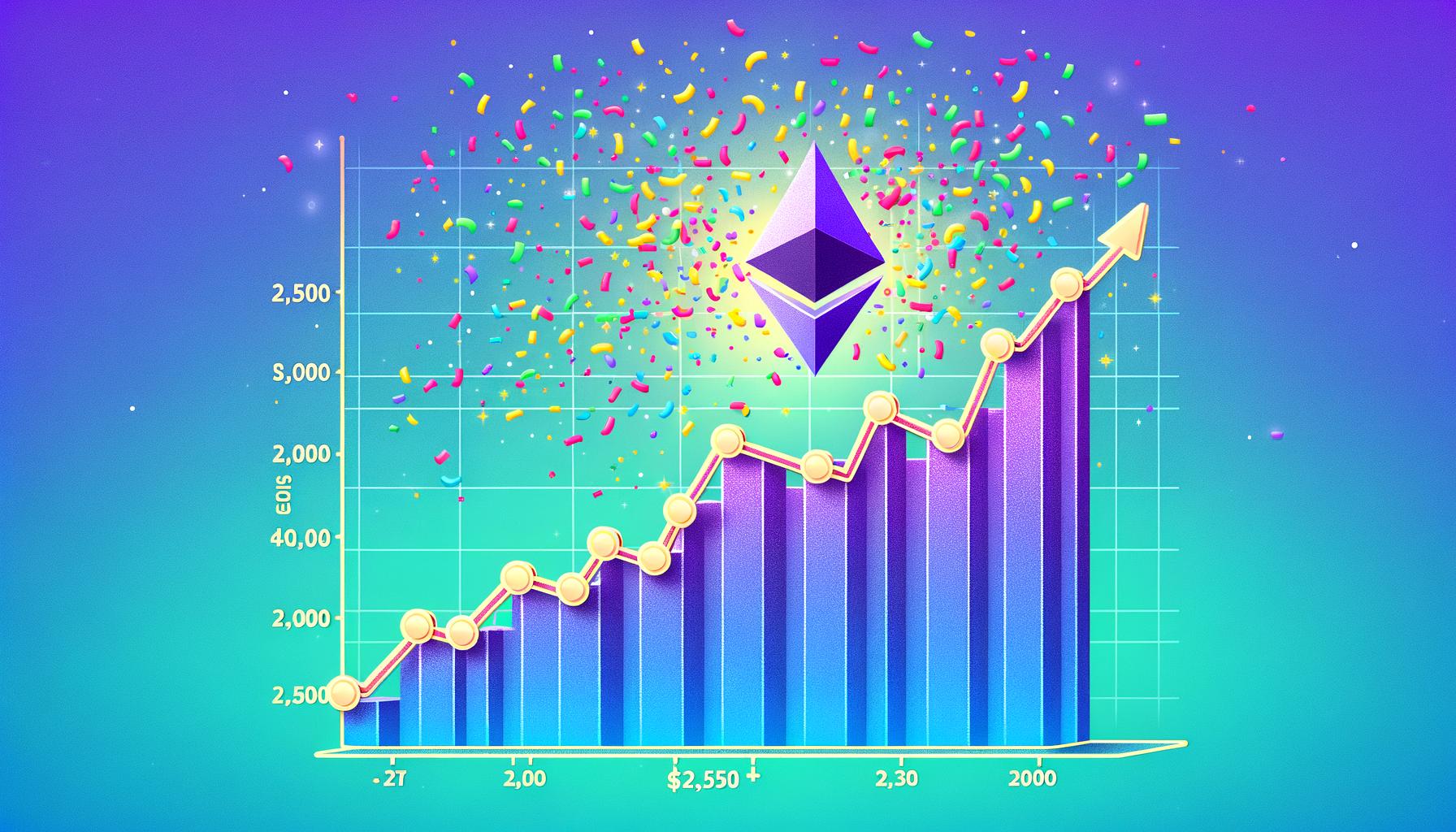

Data from the on-chain platform shows that the amount of BTC realized profits rose to $2.4 billion on Monday. In addition, Glassnode noted that the 7-day Simple Moving Average (SMA) has climbed to a value of $1.52 billion.

According to the platform, the 7-day SMA realized profits of $1.52 billion are above the Year-To-Date (YTD) average, which is about $1.4 billion. However, it remains much below the $4 billion to $5 billion peaks (7D SMA) observed from November to December last year.

Such high figures of realized profits may underscore a cautious sentiment among BTC investors. Many traders no longer feel encouraged to hold on to their coins in light of waning price performances. Should profit-taking continue, it is likely to hinder bullish attempts, triggering a correction to key support levels such as the $100,000 mark.

BTC Short-Term Holders Solely Responsible For The Profit-Taking

Alva, a market intelligence platform, has shared more insights on the worrying development. It is important to note that the ongoing wave of profit-taking on the Bitcoin network is being dominated by short-term or retail holders.

These investors appear to be capitalizing on local highs, whereas selling from long-term holders is fluctuating at historical levels. This echoes previous bull cycle pauses where powerful hands accumulate in silence, rather than panic-driven capitulation.

The platform also highlighted that ETF inflows are still strong and whale wallets are contributing to declines despite spikes in realized profits, indicating that the market’s structural demand is present. As volatility persists just near resistance levels, the volume spike and active trading hint at a temporary shakeout phase. However, this is not a full reversal phase.

If demand at lower price bands persists and ETF allocation continues, these periods could be resolved with fresh upward trends as seen in the past. With BTC hovering close to key resistance levels, the platform stressed the importance of monitoring macro triggers and the actions of short-term holders. This is due to the fact that reaccumulation among these investors might form the next price base.

Featured image from Pixabay, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

bitcoin-network-sees-rising-profit-taking-as-btcs-price-shows-signs-of-weakness

Leave a Reply