U.S. Treasury yields moved lower as investors monitored whether the Senate would pass President Donald Trump’s divisive spending bill over the next few hours.

The benchmark 10-year Treasury yield was more than 2 basis points lower at 4.261%, and the 30-year yield moved more than 2 basis points lower to 4.819%. The 2-year yield slipped more than 1 basis point to 3.727%.

One basis point is equal to 0.01%, and yields and prices move in opposite directions.

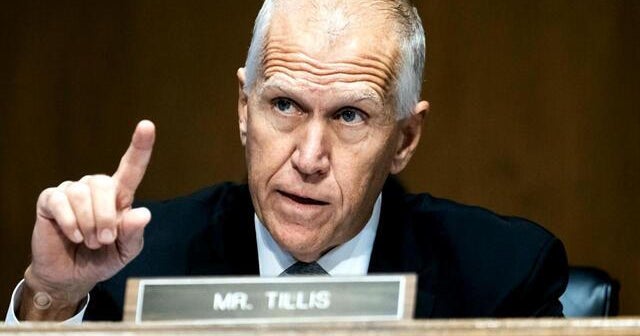

Trump’s “big, beautiful bill” passed a key procedural hurdle in the Senate on Saturday and is now slated for a final debate in the Senate.

The package could add over $3.9 trillion to the national debt, per a Congressional Budget Office analysis. Trump is pushing lawmakers to pass the bill before the upcoming Independence Day holiday on July 4.

“President Trump is committed to keeping his promises, and failure to pass this bill would be the ultimate betrayal,” the White House said in a statement of administration policy on Saturday.

On the tariffs front, Trump said over the weekend that he will be “terminating ALL discussions on Trade with Canada,” after Ottawa decided to impose a digital services tax on American firms. However, Canada walked back the tax on Sunday night, saying it’s in the interest of mutually beneficial comprehensive trade arrangements. The U.S. and China had separately finalized a framework on trade on Friday.

Monday is quiet in terms of economic data, but investors will follow the ISM Manufacturing PMI and JOLTs job openings on Tuesday, as well as non-farm payrolls on Thursday.

investors-monitor-vote-on-trumps-spending-bill

Leave a Reply