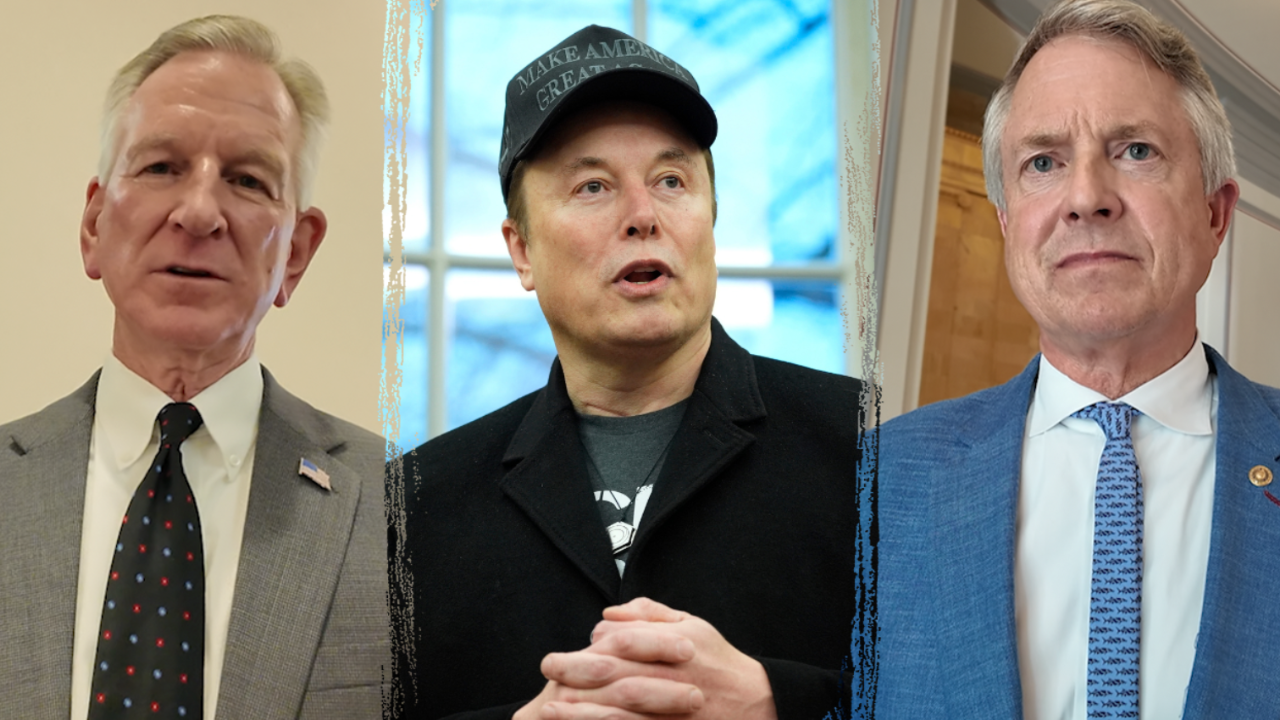

U.S. Treasury Secretary Scott Bessent (R) and U.S. Trade Representative Jamieson Greer hold a news conference in Geneva on May 12, 2025, to give details of “substantial progress” following a two-day closed-door meeting between U.S. and China top officials aimed at ending the tariff war.

Fabrice Coffrini | Afp | Getty Images

Stoxx

Analysts and strategists said on Monday that the new U.S.-China arrangement could reignite risk-on sentiment, benefiting stocks and U.S. assets.

In a note to clients on Monday, Tai Hui, chief market strategist for Asia Pacific at JPMorgan Asset Management, said the deal unveiled in Geneva was better than anticipated, but uncertainty remained.

“The magnitude of this tariff reduction is larger than expected,” he said, although he noted that it would be difficult for Beijing and Washington to reach a more concrete trade arrangement in just three months.

“The 90-day period may not be sufficient for the two sides to reach a detailed agreement, but it keeps the pressure on the negotiation process,” Hui said. “We are still waiting for further details on other terms of this agreement, for example, whether China would relax on rare earth export restrictions.”

However, Hui acknowledged the positive market reaction to the news.

“Overall, we expect the market to get back on to a risk-on sentiment in the near term,” he said. “Pressure on the [Federal Reserve] to cut rates may also ease for the time being.”

End of the ‘Sell America’ narrative?

Jordan Rochester, head of currency strategy EMEA and executive director at Mizuho Bank in London, touted the deal as “much better news than expected” in a Monday morning note. He argued that the developments would mean “the ‘Sell America’ narrative [gets] squeezed.”

U.S. assets, including the dollar, Treasurys and stocks, have seen major volatility in the weeks since Trump unveiled the full extent of his tariffs plans.

On Monday morning, the U.S. dollar index, which measures the value of the greenback against a basket of major currencies, was up 1%. The yield on the benchmark U.S. 10-year Treasury note was up by 6 basis points as the price edged lower.

According to Rochester, the 90-day deal takes the effective U.S. tariff rate — what Chinese companies will actually end up paying — from 108.8% to 27%, which he noted was well above the market consensus of a reduction to the range of 50% to 60%.

“It is also notable how [officials] played down the requirement for talks to continue past 90 days in the press conference with ‘as long as talks are constructive,'” he said. “What this means for international trade is the de facto ‘tariff wall’ has been lowered to something more workable and also raises the market pricing of other countries to get similar treatment when in talks with the US down the line.”

The better-than-expected results from the trade negotiations mean stocks could rally further, according to Wall Street strategists.

“Although stocks have rebounded, there is still much dispersion [between] domestics and exporters under the hood, dollar risk premium remains high, and overall positioning is light/defensive,” Emmanuel Cau, head of European equity strategy at Barclays, said in an emailed statement. “Pain trade to the upside means stocks have room to overshoot.”

‘Stay bullish’

Meanwhile, strategists at Deutsche Bank said their sentiment had been significantly boosted by the morning’s news. They are now expecting U.S. stocks to outperform their European rivals in the short term.

“Today’s announcement even exceeds our constructive expectations,” they said. “In our view, this announcement is not only better than we expected but also better than the market would have expected back in March.

“Although it is hard to tell how this will develop after the 90-day period, the implications for markets are clearly supportive … Stay bullish and consider stepping back into China tariff-exposed sectors (ex Autos, Health Care and Chips).”

Mikkel Emil Jensen, senior analyst at Sydbank, said the 90-day tariff pause marked a major de-escalation in the U.S.-China trade war.

“[It] removes a large chunk of uncertainty related to world trade — at least for now,” Mikkel Emil Jensen, senior analyst at Sydbank, told CNBC after the news was announced.

“The deal might be temporary, but the deal is better than expected and could ignite positive ripple effects on global trade and increase the demand for container freight,” the Sydbank analyst said. Shares of shipping giant Maersk were over 12% higher on Monday morning.

“More so, the temporary deal might boost the front-loading effect, triggering companies to increase inventories before a potential worsening of the trade war,” Jensen added.

‘Dream scenario’

Also reacting to the news, Wedbush’s Dan Ives said he believed the U.S.-China deal was “clearly just the start of broader and more comprehensive negotiations,” describing the news as “a huge win for the market and bulls.”

“We would expect both these tariff numbers to move down markedly over the coming months as deal talks progress,” he said in a note. “The baseline view heading into the weekend was some de-escalation of US/China tariffs and the agreement for more talks … instead in a dream scenario this morning [officials] came out of these talks with massive cuts to reciprocal tariffs.”

Ives, who’s known for his bullish outlook on tech, argued that the agreement meant new highs for markets and tech stocks were “now on the table in 2025.”

Trade between the world’s two largest economies is expected to swiftly resume following the cut in tariffs, reversing the decline in freight vessels and shipping containers since the tariffs announcement in early April.

Lindsay James, investment strategist at Quilter, said the new deal was “not quite as good as the 20% level that existed before so-called Liberation Day,” but added that the temporary agreement would enable “a considerable proportion of trade resume, albeit at slightly higher prices.”

— CNBC’s Sam Meredith contributed to this report.

markets-expect-tariffs-relief-new-highs-in-2025

Leave a Reply